refer to table 13-16. what is the marginal cost of the 4th unit of output

Affiliate 7. Cost and Industry Structure

7.2 The Structure of Costs in the Brusk Run

Learning Objectives

By the end of this section, you lot will be able to:

- Clarify brusk-run costs as influenced by total cost, stock-still toll, variable cost, marginal toll, and boilerplate toll.

- Summate average profit

- Evaluate patterns of costs to determine potential profit

The toll of producing a firm's output depends on how much labor and physical capital the firm uses. A listing of the costs involved in producing cars will look very unlike from the costs involved in producing computer software or haircuts or fast-food meals. However, the cost structure of all firms tin can be broken down into some common underlying patterns. When a house looks at its total costs of production in the brusk run, a useful starting indicate is to dissever total costs into 2 categories: fixed costs that cannot exist changed in the brusk run and variable costs that can be inverse.

Fixed and Variable Costs

Fixed costs are expenditures that do non change regardless of the level of product, at to the lowest degree not in the brusk term. Whether you produce a lot or a piddling, the fixed costs are the same. One example is the rent on a factory or a retail space. Once you lot sign the lease, the rent is the same regardless of how much you produce, at least until the lease runs out. Fixed costs can have many other forms: for instance, the price of machinery or equipment to produce the product, inquiry and development costs to develop new products, even an expense like advertizing to popularize a brand proper name. The level of fixed costs varies according to the specific line of business concern: for instance, manufacturing figurer fries requires an expensive mill, but a local moving and hauling business organization can become by with almost no stock-still costs at all if information technology rents trucks past the day when needed.

Variable costs, on the other hand, are incurred in the human action of producing—the more yous produce, the greater the variable cost. Labor is treated equally a variable toll, since producing a greater quantity of a skillful or service typically requires more workers or more work hours. Variable costs would also include raw materials.

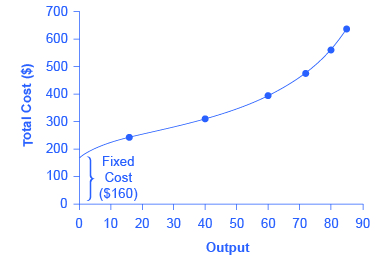

As a concrete instance of fixed and variable costs, consider the barber shop called "The Prune Joint" shown in Figure 1. The information for output and costs are shown in Tabular array 2. The fixed costs of operating the barber shop, including the space and equipment, are $160 per solar day. The variable costs are the costs of hiring barbers, which in our instance is $lxxx per barber each solar day. The first two columns of the table show the quantity of haircuts the barbershop tin can produce every bit information technology hires additional barbers. The third column shows the fixed costs, which practice non change regardless of the level of production. The fourth cavalcade shows the variable costs at each level of output. These are calculated by taking the amount of labor hired and multiplying past the wage. For example, two barbers price: 2 × $80 = $160. Calculation together the fixed costs in the tertiary column and the variable costs in the quaternary column produces the total costs in the fifth column. So, for example, with ii barbers the total cost is: $160 + $160 = $320.

| Labor | Quantity | Fixed Cost | Variable Cost | Total Cost |

|---|---|---|---|---|

| 1 | 16 | $160 | $80 | $240 |

| ii | 40 | $160 | $160 | $320 |

| three | 60 | $160 | $240 | $400 |

| 4 | 72 | $160 | $320 | $480 |

| 5 | fourscore | $160 | $400 | $560 |

| six | 84 | $160 | $480 | $640 |

| 7 | 82 | $160 | $560 | $720 |

| Tabular array 2. Output and Total Costs | ||||

The relationship between the quantity of output being produced and the cost of producing that output is shown graphically in the figure. The fixed costs are always shown as the vertical intercept of the full price curve; that is, they are the costs incurred when output is zero so there are no variable costs.

You lot tin can come across from the graph that once production starts, total costs and variable costs rise. While variable costs may initially increase at a decreasing rate, at some point they begin increasing at an increasing rate. This is caused past diminishing marginal returns, discussed in the affiliate on Choice in a Globe of Scarcity, which is easiest to see with an case. As the number of barbers increases from zip to one in the tabular array, output increases from 0 to sixteen for a marginal gain of 16; as the number rises from ane to two barbers, output increases from 16 to 40, a marginal gain of 24. From that indicate on, though, the marginal gain in output diminishes every bit each boosted hairdresser is added. For case, as the number of barbers rises from two to three, the marginal output proceeds is simply twenty; and as the number rises from three to four, the marginal proceeds is only 12.

To understand the reason behind this pattern, consider that a 1-man barber shop is a very busy functioning. The unmarried barber needs to exercise everything: say hi to people entering, respond the phone, cut hair, sweep upward, and run the cash register. A second barber reduces the level of disruption from jumping back and along betwixt these tasks, and allows a greater division of labor and specialization. The outcome can be greater increasing marginal returns. Still, as other barbers are added, the advantage of each additional hairdresser is less, since the specialization of labor can just go so far. The addition of a sixth or seventh or eighth barber only to greet people at the door will have less impact than the second one did. This is the pattern of diminishing marginal returns. Every bit a issue, the total costs of production will begin to rise more than speedily equally output increases. At some point, you may even run across negative returns as the boosted barbers begin bumping elbows and getting in each other's way. In this instance, the improver of still more barbers would really crusade output to decrease, as shown in the last row of Table 2.

This design of diminishing marginal returns is mutual in production. Every bit another example, consider the problem of irrigating a crop on a farmer's field. The plot of land is the stock-still factor of production, while the water that can be added to the state is the key variable cost. As the farmer adds water to the land, output increases. Only adding more and more than water brings smaller and smaller increases in output, until at some point the water floods the field and actually reduces output. Diminishing marginal returns occur because, at a given level of stock-still costs, each additional input contributes less and less to overall production.

Average Total Cost, Boilerplate Variable Toll, Marginal Cost

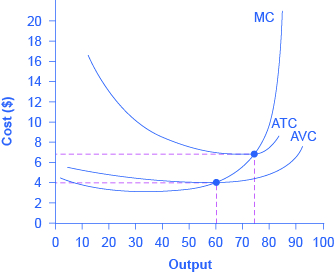

The breakup of total costs into fixed and variable costs tin provide a basis for other insights likewise. The showtime five columns of Tabular array 3 indistinguishable the previous table, only the last iii columns bear witness average total costs, boilerplate variable costs, and marginal costs. These new measures analyze costs on a per-unit (rather than a total) basis and are reflected in the curves shown in Figure 2.

| Labor | Quantity | Fixed Cost | Variable Toll | Total Cost | Marginal Cost | Boilerplate Total Cost | Average Variable Cost |

|---|---|---|---|---|---|---|---|

| 1 | sixteen | $160 | $eighty | $240 | $5.00 | $fifteen.00 | $five.00 |

| 2 | xl | $160 | $160 | $320 | $3.xxx | $8.00 | $4.00 |

| 3 | sixty | $160 | $240 | $400 | $iv.00 | $6.threescore | $4.00 |

| 4 | 72 | $160 | $320 | $480 | $six.threescore | $6.60 | $four.40 |

| five | eighty | $160 | $400 | $560 | $10.00 | $vii.00 | $five.00 |

| six | 84 | $160 | $480 | $640 | $twenty.00 | $7.60 | $5.seventy |

| Table three. Different Types of Costs | |||||||

Average full cost (sometimes referred to simply equally average price) is total cost divided past the quantity of output. Since the total cost of producing twoscore haircuts is $320, the average total cost for producing each of 40 haircuts is $320/xl, or $8 per haircut. Average cost curves are typically U-shaped, as Figure 2 shows. Average total cost starts off relatively high, because at low levels of output total costs are dominated past the stock-still cost; mathematically, the denominator is and then pocket-size that average total cost is large. Average total price then declines, as the fixed costs are spread over an increasing quantity of output. In the average cost adding, the ascension in the numerator of total costs is relatively small compared to the rise in the denominator of quantity produced. But every bit output expands however farther, the average cost begins to rise. At the right side of the average cost bend, full costs begin rising more rapidly every bit diminishing returns boot in.

Average variable price obtained when variable cost is divided by quantity of output. For example, the variable cost of producing 80 haircuts is $400, and then the boilerplate variable toll is $400/80, or $v per haircut. Note that at any level of output, the average variable cost curve will ever lie below the curve for average total cost, as shown in Figure 2. The reason is that average total price includes boilerplate variable cost and average stock-still cost. Thus, for Q = 80 haircuts, the average full cost is $viii per haircut, while the boilerplate variable cost is $5 per haircut. However, equally output grows, fixed costs become relatively less important (since they practice not rise with output), and then average variable cost sneaks closer to boilerplate cost.

Average full and variable costs measure the average costs of producing some quantity of output. Marginal cost is somewhat dissimilar. Marginal cost is the boosted price of producing i more than unit of output. Then it is non the toll per unit of all units being produced, just just the next one (or next few). Marginal cost can be calculated past taking the change in full cost and dividing it by the modify in quantity. For example, every bit quantity produced increases from 40 to 60 haircuts, total costs rise past 400 – 320, or 80. Thus, the marginal price for each of those marginal twenty units will exist 80/20, or $4 per haircut. The marginal cost curve is by and large upwardly-sloping, because diminishing marginal returns implies that additional units are more plush to produce. A pocket-size range of increasing marginal returns can be seen in the figure as a dip in the marginal toll curve before it starts rising. At that place is a point at which marginal and average costs meet, equally the following Clear it Up characteristic discusses.

Where do marginal and average costs come across?

The marginal cost line intersects the average price line exactly at the lesser of the average toll bend—which occurs at a quantity of 72 and cost of $6.60 in Effigy 2. The reason why the intersection occurs at this indicate is built into the economic pregnant of marginal and average costs. If the marginal cost of product is below the average cost for producing previous units, every bit it is for the points to the left of where MC crosses ATC, so producing one more boosted unit of measurement will reduce average costs overall—and the ATC bend volition be downward-sloping in this zone. Conversely, if the marginal cost of product for producing an boosted unit is above the average cost for producing the earlier units, as it is for points to the right of where MC crosses ATC, and then producing a marginal unit will increment average costs overall—and the ATC bend must exist upwards-sloping in this zone. The point of transition, between where MC is pulling ATC down and where it is pulling it upwards, must occur at the minimum point of the ATC curve.

This thought of the marginal cost "pulling down" the average cost or "pulling up" the boilerplate price may sound abstruse, simply think about it in terms of your ain grades. If the score on the most contempo quiz yous take is lower than your average score on previous quizzes, then the marginal quiz pulls down your boilerplate. If your score on the virtually recent quiz is college than the average on previous quizzes, the marginal quiz pulls up your average. In this aforementioned way, depression marginal costs of production first pull downwardly boilerplate costs so higher marginal costs pull them upwardly.

The numerical calculations behind boilerplate toll, average variable cost, and marginal toll volition change from firm to firm. However, the general patterns of these curves, and the relationships and economical intuition behind them, will not change.

Lessons from Alternative Measures of Costs

Breaking down total costs into fixed toll, marginal cost, average full price, and average variable cost is useful considering each statistic offers its own insights for the firm.

Whatsoever the firm's quantity of production, total revenue must exceed total costs if it is to earn a profit. As explored in the chapter Selection in a World of Scarcity, fixed costs are often sunk costs that cannot be recouped. In thinking about what to practise next, sunk costs should typically be ignored, since this spending has already been made and cannot be changed. However, variable costs tin can be changed, so they convey data virtually the firm's ability to cut costs in the nowadays and the extent to which costs volition increase if production rises.

Why are total price and average toll not on the same graph?

Total cost, fixed cost, and variable cost each reflect unlike aspects of the cost of production over the entire quantity of output being produced. These costs are measured in dollars. In contrast, marginal cost, average cost, and boilerplate variable cost are costs per unit. In the previous case, they are measured equally cost per haircut. Thus, it would non make sense to put all of these numbers on the same graph, since they are measured in different units ($ versus $ per unit of output).

It would exist equally if the vertical axis measured 2 different things. In addition, every bit a practical matter, if they were on the same graph, the lines for marginal cost, boilerplate cost, and average variable cost would appear almost flat against the horizontal axis, compared to the values for total price, stock-still cost, and variable cost. Using the figures from the previous instance, the total cost of producing 40 haircuts is $320. But the average cost is $320/40, or $viii. If you graphed both full and average cost on the same axes, the average toll would hardly bear witness.

Average toll tells a firm whether it tin can earn profits given the current price in the market. If we divide turn a profit by the quantity of output produced we get boilerplate turn a profit, also known as the house's profit margin. Expanding the equation for turn a profit gives:

[latex]\begin{array}{r @{{}={}} l}average\;profit & \frac{profit}{quantity\;produced} \\[1em] & \frac{total\;revenue\;-\;total\;cost}{quantity\;produced} \\[1em] & \frac{total\;revenue}{quantity\;produced}\;-\;\frac{full\;cost}{quantity\;produced} \\[1em] & average\;revenue\;-\;average\;cost \end{array}[/latex]

Just note that:

[latex]\begin{assortment}{r @{{}={}} l}average\;acquirement & \frac{price\;\times\;quantity\;produced}{quantity\;produced} \\[1em] & cost \cease{array}[/latex]

Thus:

[latex]average\;profit = toll\;-\;average\;cost[/latex]

This is the house's profit margin. This definition implies that if the market price is higher up average price, average turn a profit, and thus total profit, will be positive; if price is below average cost, then profits will be negative.

The marginal toll of producing an boosted unit can be compared with the marginal revenue gained by selling that additional unit to reveal whether the additional unit is calculation to total turn a profit—or not. Thus, marginal cost helps producers empathize how profits would be affected by increasing or decreasing production.

A Variety of Cost Patterns

The pattern of costs varies among industries and even among firms in the same industry. Some businesses have loftier fixed costs, but low marginal costs. Consider, for example, an Internet company that provides medical advice to customers. Such a company might be paid by consumers directly, or maybe hospitals or healthcare practices might subscribe on behalf of their patients. Setting up the website, collecting the information, writing the content, and ownership or leasing the computer space to handle the web traffic are all fixed costs that must be undertaken before the site can work. Yet, when the website is upward and running, it can provide a high quantity of service with relatively low variable costs, like the price of monitoring the system and updating the data. In this example, the full toll curve might start at a high level, considering of the loftier stock-still costs, just then might announced close to flat, up to a large quantity of output, reflecting the low variable costs of operation. If the website is popular, however, a large ascent in the number of visitors will overwhelm the website, and increasing output farther could require a purchase of additional estimator space.

For other firms, fixed costs may be relatively low. For case, consider firms that rake leaves in the fall or shovel snowfall off sidewalks and driveways in the winter. For stock-still costs, such firms may need picayune more than a car to ship workers to homes of customers and some rakes and shovels. Still other firms may find that diminishing marginal returns set up in quite sharply. If a manufacturing establish tried to run 24 hours a day, 7 days a week, little time remains for routine maintenance of the equipment, and marginal costs can increase dramatically as the business firm struggles to repair and replace overworked equipment.

Every firm tin can gain insight into its job of earning profits past dividing its full costs into fixed and variable costs, and then using these calculations as a basis for boilerplate full toll, average variable cost, and marginal price. Nevertheless, making a terminal determination about the turn a profit-maximizing quantity to produce and the toll to charge will require combining these perspectives on cost with an analysis of sales and acquirement, which in turn requires looking at the market structure in which the firm finds itself. Before nosotros turn to the analysis of marketplace structure in other chapters, nosotros will analyze the firm'southward cost structure from a long-run perspective.

Key Concepts and Summary

In a brusk-run perspective, a business firm's total costs can exist divided into fixed costs, which a firm must incur earlier producing any output, and variable costs, which the business firm incurs in the act of producing. Fixed costs are sunk costs; that is, because they are in the by and cannot be altered, they should play no role in economical decisions about future production or pricing. Variable costs typically prove diminishing marginal returns, so that the marginal toll of producing college levels of output rises.

Marginal price is calculated by taking the change in total toll (or the change in variable cost, which will exist the same thing) and dividing information technology by the change in output, for each possible change in output. Marginal costs are typically rising. A firm can compare marginal cost to the additional revenue it gains from selling another unit to detect out whether its marginal unit is adding to turn a profit.

Average total cost is calculated past taking total cost and dividing by total output at each different level of output. Average costs are typically U-shaped on a graph. If a firm's average toll of product is lower than the market toll, a firm will be earning profits.

Boilerplate variable price is calculated past taking variable price and dividing by the total output at each level of output. Average variable costs are typically U-shaped. If a firm'southward boilerplate variable cost of production is lower than the market price, then the firm would be earning profits if fixed costs are left out of the movie.

Self-Check Questions

- The WipeOut Ski Company manufactures skis for beginners. Stock-still costs are $thirty. Fill in Tabular array 4 for total price, average variable cost, average total price, and marginal cost.

Quantity Variable Cost Fixed Cost Total Cost Average Total Toll Average Variable Cost Marginal Cost 0 0 $30 1 $ten $thirty 2 $25 $30 3 $45 $thirty iv $70 $thirty five $100 $xxx 6 $135 $xxx Table 4. - Based on your answers to the WipeOut Ski Company in Cocky-Bank check Question i, now imagine a situation where the business firm produces a quantity of 5 units that it sells for a cost of $25 each.

- What will be the company'southward profits or losses?

- How can you tell at a glance whether the visitor is making or losing money at this cost past looking at average toll?

- At the given quantity and price, is the marginal unit produced adding to profits?

Review Questions

- What is the difference between fixed costs and variable costs?

- Are there fixed costs in the long-run? Explain briefly.

- Are stock-still costs also sunk costs? Explicate.

- What are diminishing marginal returns as they relate to costs?

- Which costs are measured on per-unit basis: stock-still costs, average price, average variable cost, variable costs, and marginal cost?

- How is each of the following calculated: marginal price, boilerplate total cost, boilerplate variable cost?

Critical Thinking Questions

- A common proper noun for stock-still cost is "overhead." If you divide fixed cost by the quantity of output produced, you get boilerplate fixed cost. Supposed fixed price is $i,000. What does the average fixed price curve look like? Use your response to explain what "spreading the overhead" means.

- How does fixed price affect marginal price? Why is this relationship important?

- Average cost curves (except for average fixed cost) tend to be U-shaped, decreasing and so increasing. Marginal price curves have the same shape, though this may be harder to meet since most of the marginal cost bend is increasing. Why do you think that average and marginal price curves have the aforementioned full general shape?

Bug

- Return to Figure 1. What is the marginal gain in output from increasing the number of barbers from 4 to v and from 5 to 6? Does it continue the blueprint of diminishing marginal returns?

- Compute the average full cost, average variable toll, and marginal cost of producing 60 and 72 haircuts. Draw the graph of the three curves between sixty and 72 haircuts.

Glossary

- average profit

- turn a profit divided by the quantity of output produced; profit margin

- average total price

- total cost divided past the quantity of output

- boilerplate variable cost

- variable cost divided by the quantity of output

- fixed toll

- expenditure that must be made earlier production starts and that does not change regardless of the level of production

- marginal cost

- the additional toll of producing one more unit

- total cost

- the sum of fixed and variable costs of production

- variable cost

- cost of production that increases with the quantity produced

Exercises

Answers to Self-Cheque Questions

-

Quantity Variable Cost Fixed Cost Total Cost Average Total Cost Average Variable Cost Marginal Cost 0 0 $xxx $30 – – 1 $10 $30 $40 $10.00 $40.00 $x 2 $25 $30 $55 $12.50 $27.fifty $15 3 $45 $30 $75 $15.00 $25.00 $xx 4 $seventy $30 $100 $17.50 $25.00 $25 v $100 $thirty $130 $xx.00 $26.00 $thirty vi $135 $30 $165 $22.fifty $27.50 $35 Tabular array v. -

- Total revenues in this example will exist a quantity of five units multiplied past the price of $25/unit of measurement, which equals $125. Full costs when producing five units are $130. Thus, at this level of quantity and output the firm experiences losses (or negative profits) of $5.

- If toll is less than average price, the firm is not making a profit. At an output of five units, the boilerplate cost is $26/unit of measurement. Thus, at a glance you can encounter the business firm is making losses. At a second glance, you lot can see that it must be losing $1 for each unit produced (that is, boilerplate cost of $26/unit minus the price of $25/unit). With five units produced, this ascertainment implies total losses of $five.

- When producing v units, marginal costs are $30/unit. Toll is $25/unit. Thus, the marginal unit is not adding to profits, but is actually subtracting from profits, which suggests that the business firm should reduce its quantity produced.

Source: https://opentextbc.ca/principlesofeconomics/chapter/7-2-the-structure-of-costs-in-the-short-run/

0 Response to "refer to table 13-16. what is the marginal cost of the 4th unit of output"

Post a Comment